The Ultimate Iowa Farmland Sellers Resource Guide and FAQ

Hi, I’m Jason Smith. I’m an auctioneer. Not just an auctioneer but a farmland auctioneer. I help people market and sell farms and land. I am also a licensed land broker. The only thing I sell is farmland. My wife Nicole and I created this Iowa farmland company to bring a safe place for sellers to get representation in selling farmland in Iowa. Over 15 years have passed since then and we’ve sold over 1,000 parcels of land for various clients. We’ve handled large and complex land transactions and many standard farmland estate sales. Along the way, we’ve seen everything you can imagine. We’ve built a vast array of resources that are important to land sellers. As you can imagine on a daily basis, we answer the same questions. We thought it might be most helpful to our potential clients to put those questions and resources all in one place! We will continue to update this page with the latest information but you are always free to call or text us at 515-537-6633.

Terms and Definitions Relating to Farmland Ownership and Sales

Real estate industry terminology can make the process of selling farmland confusing and frustrating. Here are some of the terms you might hear and a description of what they mean. These are the most common terms described in plain language. If you have something you don’t understand reach out and I will help you.

| Term | Definition | Term | Definition |

|---|---|---|---|

| Acre | An acre is a measurement of land. It is about the size of a football field. | Farmland | Farmland becomes a meaningful term outside of its general description of land. The Farm Service Agency uses the term farmland to mean all land excluding non taxable acres. See Cropland. |

| Auction | An auction is a method of marketing. It is more than a 1 time event. Auctions are competitive ascending bidding. They differ from a privately negotiated sale and put the seller in charge of setting all sale terms. | Cropland | Cropland is land where crop is grown. Farmland isn't necessarily. Cropland is a term used by the Farm Service Agency to define acres certified as producing a crop. These are the acres that will actually produce income. |

| Listing | This is a term that is often use to refer to a method of privately negotiated sale of farmland. It is the opposite of an auction. In this method the buyer sets all sale terms and offers to the seller. | Deed | A deed is a legal document that transfers the property to its owner. It is recorded in the county recorders office. There are different kinds of deeds that impart different legal situations. Common deeds include General Warranty, Special Warranty, Bargain and Sale, Quitclaim, Deed of Trust, Reconveyance, Trustee's and Court Ordered. |

| Joint Tenants | Joint tenants is a form of ownership where you jointly own a property and on the death of one owner their share passes to the surviving owner. You would own property like this with your spouse, but it is highly unlikely and dangerous to own property like this with siblings or other non family. | Probate | Probate is a court supervised settlement of an estate. A trust can help you avoid this process. Often when a person dies without a will or trust the court will appoint an "executor" to gather and value the assets in the estate. Remaining debts will be settled and assets distributed to the heirs all in the eye of the courts. Probate is meant to prevent fraud and theft after a death. |

| Tenants in Common | An extremely common type of ownership when you are inheriting family farmland. In this ownership you own an undivided interest in the property. In other words you can't point to "your acres". You have unity of possession with all other owners. This is also called fractional ownership. | Executor | A person appointed by the court to oversee the settlement of an estate of a person that died without a will or trust. |

| Trust | Trusts are a simple way to transfer assets from one person to another. Trusts help avoid probate and possibly avoid some taxes. Trusts formed by somebody will appoint another person to "manage" the assets in the trust. This manager is a "Trustee" which is different than a "beneficiary" or the person receiving the benefit of the trust. | Estate | An estate is the total, real and personal, property owned by an individual on their death. This includes everything the person owned from household furnishing, real estate, to bank accounts, special rights, patents, copyrights, etc. |

| Auctioneer | An auctioneer is a person that uses the auction method of marketing to dispose of an liquidate assets for other persons. | Bidders | Bidders are people that desire to purchase and place a bid on an asset that is offered for sale at an auction. |

| Online Only Auction | An online only auction is an auction where the auction portion of the marketing campaign is held online with no other alternative ways to bid. | CSR | Corn Suitability Rating. Also known as CSR2 which was the 1st recision. CSR is a measurement that goes from 5-100. Each soil is assigned a value and every farm is comprised of multiple soils. A mathematical formula creates a "weighted average" of all the soils to produce a value between 5 and 100. Initially created to equalize taxation CSR today can be an element of the properties market value. The definition of CSR is "A measure of a farms ability to be intensely farmed over a long period of time". It should never be confused with "fertility" |

| Hybrid Auction | Many auctioneers call this type of auction by different names. It is an auction where bidders bid in person OR online. The auction has 2 ways to bid and is synchronized by the auctioneers conducting the auction. | Soil Fertility | Soil fertility is a measure of the necessary elements in the soil for growing a crop. CSR is often confused as soil fertility but has nothing to do with fertility. Fertility is a measure of things like nitrogen, phosphorus, boron, and calcium. |

| Live Auction | A live auction is what you see as an "old fashioned" auction. The kind where the auctioneer conducts a live outcry of bids and people raise their hand to bid. This type of auction would be a hybrid auction is online bidding is added to it. In its most pure form, it has no online bidding. | Soil Testing | Soil testing is a process of collecting samples of soil on a farm and submitting them to a labratory for analysis of the crop nutrients, organic matter and/or microbes. |

| Absolute Auction | An absolute auction is an auction where NO minimum is set or expected by the seller. The seller offers the property to the pubic and agrees regardless of the final bid they will accept it with no argument. This is a legally defined concept that must be adhered to or the buyer will have legal remedies to force a seller to perform. | Land Investor | This term is loosely used to describe a person that desires to buy land but is not a farmer. |

| Reserved Auction | Most farmland sellers prefer to use a reserved auction. In this case they hold the right to say no to the final bid and deny a sale. Buyers have no legal recourse if a seller offers a property by reserved auction and then does not sell the property. | Confirmed Auction | This is used to describe a RESERVED auction that has achieved the sellers reserve. Absent any withdrawn bids the seller has confirmed they will accept the eventual high bid. This is different than an Absolute auction and has different legal ramifications. |

| Absentee Bid | A person may place a bid with an auctioneer prior to an auction but not attend the auction. In this case the auctioneer would advance bidding at the same increment for this bidder as necessary to keep them in the lead, but only after other bidders have placed bids. | Earnest Deposit | An earnest deposit is a deposit placed with the auction company by the winning bidder to ensure their attendance at the closing table in the future. Earnest deposits are NOT refundable in our auctions at DreamDirt. If a buyer fails to close the earnest deposit forfeits to the seller. |

| Appraisal | An appraisal is a formal evaluation of an asset to determine its fair market value, or its value on a particular date. Backdated appraisals are often known as "Date of Death" Appraisals and are common in estate situations. | As-Is | Often stated as "As-Is Where-Is" is an important element in many auctions where the seller offers the property as it is, where it is. This means they make no guarantee of anything and will not be financially responsible after the sale for anything. This is an important legal protection sellers enjoy using auctions. The where is is less important with real estate than in personal property auctions. |

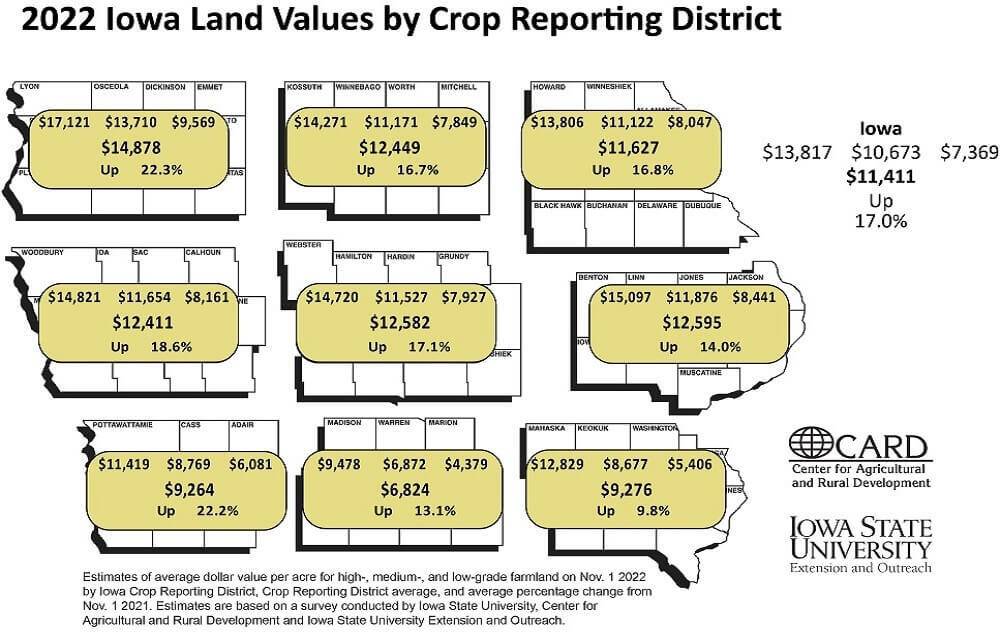

Average Farmland Prices in Iowa 2022

The data in this table is from the Iowa State University Land value survey released in December 2022. The data was collected for the period September 2021 to September 2022. That said, it is the only official data available during the 2022 crop year. We can compensate for this by adjusting by appreciation percentage which requires indepth knowledge of the land market. Think of this data as a picture in time. If you imagine it as progress, it has progressed more since then. We’ve experienced particularly high farmland price appreciation throughout 2021 with 29% price appreciation. Then in 2022 we saw another 17% gain. These figures already include the 17% land price appreciation of 2022 but adjusting for 2023 price appreciation becomes a judgment call. In 2023 its hard to imagine a scenario of continuing price apprecition at the rates we’ve seen through 2021 and 2022. It is important to involve a professional in helping you value your farmland. If a sale of your land is on the horizon contact us and we will provide you with a free market evaluation of your farmland.

Calculating the Value of Iowa Farmland by CSR2

We often speak in general terms about “Dollars per CSR Point” which is a really simple way of understanding the value of farmland. First of all, CSR is the Corn Suitability Rating. Every farm has one. Currently, we are on the CSR2 ratings which was an update from the original CSR. CSR is a measure of a farm’s ability to be intensively farmed over a long period of time. It has nothing to do with fertility.

Every farm has a CSR2 rating. Let’s work on a few examples. Let’s say you have a farm that is an 80 CSR2 rating. You look at our data and see that farms in your county are averaging $151 per CSR point. The math looks like this. Take 80 CSR2 X $151 per point and you can learn that your farm is worth $12,080 according to the averages. It is a great place to start and set expectations.

To reverse this, you might also learn that a farm sold for $9,500 per acre. You could learn that the CSR2 was 67. Take $9,500 per acre divided by 67 CSR and the farm sold for $141.79 per point. Now if you own a farm in the same area and it has a 76 CSR2 rating you can use the $141.79 to estimate the value of your farm. 76 CSR2 X $141.79 and see your farm is worth $10,776 per acre compared to that sale. It is not an exact science but it puts you most times within 10% of the truth.

Iowa Farmland Prices by County

DreamDirt thoroughly collects all farmland auction results across the state and provides them free to everybody. Click on the county in the Iowa map below that you want to examine. Each page will list the particular details and financial figures for that county.

Our In-Depth Land Knowledge is Free

Empower yourself with information before you decide to sell.

Iowa Farmland Prices by District Region

| Region | Average Farmland Value | Price Appreciation from 2020 to 2021 |

Value Rank |

|---|---|---|---|

| Northwest Iowa | $14,878 | 22.3% | 1 |

| North Central Iowa | $12,449 | 16.7% | 4 |

| Northeast Iowa | $11,627 | 16.8% | 6 |

| West Central Iowa | $12,411 | 18.6% | 5 |

| Central Iowa | $12,582 | 17.1% | 3 |

| East Central Iowa | $12,595 | 14.0% | 2 |

| Southwest Iowa | $9,264 | 22.2% | 8 |

| South Central Iowa | $6,824 | 13.1% | 9 |

| Southeast Iowa | $9,276 | 9.6% | 7 |

We sold our real estate using DreamDirt’s Online Auction and in the end the high bid was higher than we would have dreamed of getting!

~ Barb Hocker, Land Seller

Lee County, Iowa

Jason is knowledgeable and will guide you through the entire process. He and his team are professional and friendly. I was most impressed with how responsive they are! The marketing resulted in a great auctions for us and I would recommend them to you!

~ Kris Whetstone, Farmland Seller

Guthrie County, Iowa

When I inherited my family farm I contacted Jason to help sell it. He was so knowledgable and the marketing for our farm was outstanding! On Auction day DreamDirt sold the farm for way more than I ever thought it would sell for!

~ Chad Schneider, Farmland Seller

Plymouth County, Iowa

Iowa Farm Real Estate Search Websites

All 99 County Assessors in Iowa provide online land records that allow you as a landowner some important research opportunities. Most of the websites list recent farmland sale prices, dates of sale, CSR2 ratings, taxes and assessments, property boundaries, acreage figures, improvement details, and maps or diagrams of each property. Choose the county your land is located in and find your farmland. If you need help let us know!

How Much Does Farmland Rent For Per Acre in Iowa?

There a different ways to calculate farmland cash rental rates in Iowa. We have included the base data from Iowa State University here. This data is NOT derived from actual farmland rental contracts in Iowa. Rather it is collected using a “survey” in order to establish a value for each county in Iowa. It is important to note that survey respondents are under no obligation to use actual figures. Further, survey respondents could have a financial stake in the numbers being low or high. It is my experience that these numbers tend to be low. There are at least two reasons for that.

First, while rents move in step with land prices which follow commodity prices you end up with rental prices being 3rd in line. The rental rates survey comes out in the early part of the year after the land value survey has come out in the late part of the year. The land value survey comes at the end of the crop season and the rental survey comes at the start of the next season. You end up with commodity prices moving, then land values increasing and as a result, land rents go up.

It’s hard to look at land values and rents in any of the surveys and compare them side by side. As a landowner, you are likely doing yourself a disservice. You will find that most times when you negotiate with a tenant on farmland rental rates, they will quote this survey. That might be a clue that the information is advantageous. We conduct farmland cash rent auctions in Iowa and other states multiple times a year and we find our results tend to be about 30-40% above the figures in this chart.

How do I Calculate Farmland Cash Rent in Iowa

Farmland cash rents are typically based on the value of the land which is based on the quality of the land. Yield isn’t always a function of the quality of the land but is expected to be. Differences in farming practices, weather, and pests can sometimes throw that rule off. That said there are ways to break down the value of the farmland rent.

- Based on the value of the land. Typically, this is a figure that ranges from 2.5% to 3.5% of the actual value of the farmland. The trick is knowing the value of your land, it changes every year. You can always check in with DreamDirt, we post regular articles on our Farmland Sales Blog. This calculation might look like this $14,500 value per acre X .025 (2.5%) = $362.50 per acre annual rent

- Based on the Crop Yield. You can use the USDA’s NASS data for your county to determine the average corn or soybean yield or even history from your farm to determine a rental factor. This calculation might look like this 219 Bushel County Average X $1.42 per bushel = $310.98 per acre annual rent

- Based on Soil Productivity. In Iowa, we use CSR2 ratings to determine the quality of the land. Each farm is assigned a CSR2 rating known as a “weighted average” of all of the soils on it. This calculation might look like this 75 CSR2 X $3.12 per CSR2 Point = $234 per acre annual cash rent.

A few important considerations when renting a farm to somebody.

- Will your lease be written or verbal? If it’s verbal it is a 1-year lease that AUTOMATICALLY renews annually unless you notify the tenant IN WRITING prior to September 1st.

- You can always consider flex options, that will allow you to share in any upside during good years. The flip side of that is, that you share in the pain of worse years.

- Multi-year rental leases typically get you the best tenants. It gets your farm the best treatment. The cash rent does not have to be the same every year. I’d suggest using an escalator stated as a percentage of the agreed-upon amount. The tenant gets a multi-year lease. You know your income will grow annually.

- When renting a farm make sure all expenses are covered in the agreement. If there is electric service to the property who will pay for it? If repairs need to be made who is responsible? If there are structures on the property such as machine sheds, grain bins, or homes who will maintain them. Are they included in the lease?

- Who will maintain or be financially responsible for access? Tubes? Roads? Tile? Fences?

- Will the tenant be allowed to remove crop residue in the final year of the agreement? Typically, this isn’t allowed. If you do allow it, realize it may hurt the value of your future rental agreement as the new incoming tenant will need to compensate with additional fertilizer.

- Will you be given access to yield maps, and fertilizer application records?

- Are there government programs on the farm? Who will get the income from them?

- Are hunting rights included in the lease? Is hunting prohibited use of the property? If it is allowed who is liable and responsible for accidents?

- Who is required to carry insurance and how much insurance?

- Is the tenant allowed to cut and sell timber from the property? Often timber is a separate crop but not covered in farmland rental agreements.

- What happens if cash rent payments are not made on time?

| County | Average County CSR2 |

Average Cropland CSR2 |

Average County Farmland Rent |

Highest | Mid | Lowest | Rent Per Bushel Corn |

Average Rent per CSR2 |

|---|---|---|---|---|---|---|---|---|

| Adair County Average Farmland Rents | 64 | 79 | $213 | $241 | $212 | $186 | $1.27 | $2.70 |

| Adams County Average Farmland Rents | 61.1 | 79 | $249 | $284 | $248 | $214 | $1.42 | $3.15 |

| Allamakee County Average Farmland Rents | 40.8 | 76 | 225 | $264 | $214 | $196 | $1.16 | 2.96 |

| Appanoose County Average Farmland Rents | 46.7 | 70 | $184 | $218 | $176 | $158 | $1.12 | $2.63 |

| Audubon County Average Farmland Rents | 69.3 | 77 | $276 | $322 | $279 | $228 | $1.39 | $3.58 |

| Benton County Average Farmland Rents | 78.9 | 86 | $266 | $301 | $270 | $226 | $1.35 | $3.09 |

| Black Hawk County Average Farmland Rents | 73.9 | 86 | $263 | $317 | $263 | $210 | $1.34 | $3.06 |

| Boone County Average Farmland Rents | 75.5 | 85 | $262 | $297 | $257 | $232 | $1.38 | $3.08 |

| Bremer County Average Farmland Rents | 75.5 | 84 | $291 | $344 | $290 | $239 | $1.42 | $3.46 |

| Buchanan County Average Farmland Rents | 75.8 | 83 | $275 | $305 | $275 | $245 | $1.32 | $3.31 |

| Buena Vista County Average Farmland Rents | 83.4 | 86 | $265 | $303 | $263 | $230 | $1.38 | $3.08 |

| Butler County Average Farmland Rents | 74.6 | 80 | $293 | $336 | $297 | $247 | $1.42 | $3.66 |

| Calhoun County Average Farmland Rents | 82.2 | 84 | $240 | $278 | $238 | $203 | $1.24 | $2.86 |

| Carroll County Average Farmland Rents | 76.5 | 80 | $272 | $312 | $275 | $231 | $1.35 | $3.40 |

| Cass County Average Farmland Rents | 69.5 | 79 | $242 | $272 | $243 | $213 | $1.26 | $3.06 |

| Cedar County Average Farmland Rents | 76.9 | 86 | $251 | $288 | $249 | $215 | $1.26 | $2.92 |

| Cerro Gordo County Average Farmland Rents | 74.6 | 79 | $254 | $286 | $251 | $224 | $1.31 | $3.22 |

| Cherokee County Average Farmland Rents | 82.2 | 90 | $305 | $344 | $302 | $296 | $1.50 | $3.39 |

| Chickasaw County Average Farmland Rents | 77.2 | 83 | $284 | $342 | $285 | $225 | $1.43 | $3.42 |

| Clarke County Average Farmland Rents | 47.2 | 77 | $217 | $250 | $226 | $176 | $1.36 | $2.82 |

| Clay County Average Farmland Rents | 79.9 | 86 | $253 | $300 | $256 | $202 | $1.38 | $2.94 |

| Clayton County Average Farmland Rents | 43.9 | 68 | $267 | $325 | $265 | $212 | $1.34 | $3.93 |

| Clinton County Average Farmland Rents | 63 | 74 | $260 | $293 | $261 | $227 | $1.29 | $3.51 |

| Crawford County Average Farmland Rents | 68.6 | 73 | $293 | $348 | $282 | $249 | $1.37 | $4.01 |

| Dallas County Average Farmland Rents | 76.6 | 88 | $267 | $302 | $266 | $234 | $1.48 | $3.03 |

| Davis County Average Farmland Rents | 46.7 | 70 | $170 | $202 | $168 | $139 | $1.15 | $2.43 |

| Decatur County Average Farmland Rents | 40.1 | 75 | $163 | $191 | $167 | $131 | $0.98 | $2.17 |

| Delaware County Average Farmland Rents | 65.1 | 77 | $321 | $374 | $320 | $269 | $1.52 | $4.17 |

| Des Moines County Iowa Land Auction | 67 | 84 | $253 | $306 | $252 | $201 | $1.32 | $3.01 |

| Dickinson County Average Farmland Rents | 79.9 | 87 | $230 | $264 | $226 | $201 | $1.30 | $2.64 |

| Dubuque County Average Farmland Rents | 49.2 | 69 | $324 | $368 | $339 | $266 | $1.53 | $4.70 |

| Emmet County Average Farmland Rents | 77.2 | 81 | $243 | $278 | $248 | $202 | $1.32 | $3.00 |

| Fayette County Average Farmland Rents | 68.2 | 81 | $287 | $323 | $288 | $252 | $1.44 | $3.54 |

| Floyd County Average Farmland Rents | 79.5 | 83 | $232 | $261 | $233 | $202 | $1.18 | $2.80 |

| Franklin County Average Farmland Rents | 79.4 | 81 | $270 | $309 | $270 | $231 | $1.36 | $3.33 |

| Fremont County Average Farmland Rents | 72.1 | 80 | $222 | $256 | $221 | $189 | $1.14 | $2.78 |

| Greene County Average Farmland Rents | 78.3 | 82 | $259 | $288 | $262 | $226 | $1.32 | $3.16 |

| Grundy County Average Farmland Rents | 86.9 | 88 | $300 | $338 | $301 | $262 | $1.44 | $3.41 |

| Guthrie County Average Farmland Rents | 61.4 | 83 | $247 | $283 | $249 | $210 | $1.29 | $2.98 |

| Hamilton County Average Farmland Rents | 79.1 | 80 | $248 | $285 | $245 | $213 | $1.33 | $3.10 |

| Hancock County Average Farmland Rents | 74.6 | 76 | $257 | $300 | $251 | $219 | $1.31 | $3.38 |

| Hardin County Average Farmland Rents | 79.5 | 84 | $269 | $315 | $267 | $226 | $1.37 | $3.20 |

| Harrison County Average Farmland Rents | 61.2 | 73 | $283 | $337 | $280 | $233 | $1.55 | $3.88 |

| Henry County Average Farmland Rents | 63.8 | 81 | $252 | $294 | $249 | $214 | $1.42 | $3.11 |

| Howard County Average Farmland Rents | 76.9 | 83 | $252 | $284 | $258 | $213 | $1.29 | $3.04 |

| Humboldt County Average Farmland Rents | 80.3 | 81 | $262 | $306 | $267 | $214 | $1.37 | $3.23 |

| Ida County Average Farmland Rents | 77.1 | 81 | $296 | $337 | $293 | $259 | $1.38 | $3.65 |

| Iowa County Average Farmland Rents | 62.5 | 79 | $245 | $273 | $259 | $203 | $1.27 | $3.10 |

| Jackson County Average Farmland Rents | 44 | 67 | $267 | $317 | $268 | $218 | $1.38 | $3.99 |

| Jasper County Average Farmland Rents | 68.5 | 80 | $280 | $316 | $276 | $248 | $1.31 | $3.50 |

| Jefferson County Average Farmland Rents | 61 | 79 | $253 | $314 | $249 | $195 | $1.47 | $3.20 |

| Johnson County Average Farmland Rents | 65 | 85 | $243 | $294 | $238 | $197 | $1.27 | $2.86 |

| Jones County Average Farmland Rents | 62.2 | 77 | $285 | $330 | $286 | $238 | $1.43 | $3.70 |

| Keokuk County Average Farmland Rents | 63 | 80 | $232 | $295 | $218 | $181 | $1.30 | $2.90 |

| Kossuth County Average Farmland Rents | 78.2 | 79 | $267 | $301 | $274 | $227 | $1.38 | $3.38 |

| Lee County Average Farmland Rents | 52.3 | 75 | $284 | $329 | $279 | $244 | $1.60 | $3.79 |

| Linn County Average Farmland Rents | 68.1 | 87 | $280 | $328 | $268 | $245 | $1.37 | $3.22 |

| Louisa County Average Farmland Rents | 63.7 | 80 | $236 | $280 | $234 | $193 | $1.23 | $2.95 |

| Lucas County Average Farmland Rents | 43.8 | 73 | $203 | $248 | $202 | $159 | $1.28 | $2.78 |

| Lyon County Average Farmland Rents | 75.1 | 80 | $294 | $338 | $280 | $263 | $1.45 | $3.68 |

| Madison County Average Farmland Rents | 60.8 | 86 | $214 | $254 | $210 | $179 | $1.21 | $2.49 |

| Mahaska County Average Farmland Rents | 68.2 | 81 | $218 | $267 | $213 | $174 | $1.14 | $2.69 |

| Marion County Average Farmland Rents | 59.7 | 80 | $238 | $279 | $243 | $193 | $1.27 | $2.98 |

| Marshall County Average Farmland Rents | 75.7 | 82 | $286 | $327 | $289 | $241 | $1.29 | $3.49 |

| Mills County Average Farmland Rents | 71.8 | 82 | $272 | $312 | $268 | $236 | $1.38 | $3.32 |

| Mitchell County Average Farmland Rents | 80.9 | 83 | $264 | $303 | $260 | $228 | $1.31 | $3.18 |

| Monona County Average Farmland Rents | 59.1 | 71 | $289 | $342 | $282 | $243 | $1.51 | $4.07 |

| Monroe County Average Farmland Rents | 48.3 | 82 | $174 | $213 | $171 | $139 | $1.06 | $2.12 |

| Montgomery County Average Farmland Rents | 70.3 | 79 | $245 | $278 | $250 | $207 | $1.24 | $3.10 |

| Muscatine County Average Farmland Rents | 64.9 | 83 | $248 | $295 | $250 | $198 | $1.28 | $2.99 |

| O’Brien County Average Farmland Rents | 91.4 | 94 | $283 | $324 | $276 | $249 | $1.37 | $3.01 |

| Osceola County Average Farmland Rents | 86.3 | 86 | $274 | $325 | $281 | $215 | $1.41 | $3.19 |

| Page County Average Farmland Rents | 70.6 | 80 | $222 | $256 | $221 | $189 | $1.14 | $2.78 |

| Palo Alto County Average Farmland Rents | 77 | 82 | $258 | $288 | $257 | $228 | $1.39 | $3.15 |

| Plymouth County Average Farmland Rents | 73.5 | 82 | $274 | $308 | $268 | $246 | $1.34 | $3.34 |

| Pocahontas County Average Farmland Rents | 81.2 | 82 | $255 | $284 | $252 | $228 | $1.32 | $3.11 |

| Polk County Average Farmland Rents | 70.7 | 89 | $256 | $298 | $250 | $220 | $1.35 | $2.88 |

| Pottawattamie County Average Farmland Rents | 68.4 | 79 | $263 | $292 | $266 | $231 | $1.32 | $3.33 |

| Poweshiek County Average Farmland Rents | 67.9 | 79 | $256 | $294 | $259 | $217 | $1.31 | $3.24 |

| Ringgold County Average Farmland Rents | 50.2 | 76 | $208 | $246 | $205 | $172 | $1.27 | $2.74 |

| Sac County Average Farmland Rents | 82.8 | 86 | $284 | $312 | $284 | $255 | $1.39 | $3.30 |

| Scott County Average Farmland Rents | 72.4 | 89 | $310 | $353 | $311 | $265 | $1.53 | $3.48 |

| Shelby County Average Farmland Rents | 69.6 | 72 | $276 | $313 | $274 | $241 | $1.37 | $3.83 |

| Sioux County Average Farmland Rents | 85.3 | 88 | $313 | $347 | $310 | $281 | $1.49 | $3.56 |

| Story County Average Farmland Rents | 80.2 | 86 | $275 | $309 | $272 | $245 | $1.48 | $3.20 |

| Tama County Average Farmland Rents | 70.3 | 85 | $282 | $328 | $285 | $234 | $1.41 | $3.32 |

| Taylor County Average Farmland Rents | 58.5 | 81 | $236 | $272 | $229 | $208 | $1.39 | $2.91 |

| Union County Average Farmland Rents | 63.2 | 85 | $213 | $260 | $209 | $170 | $1.27 | $2.51 |

| Van Buren County Average Farmland Rents | 49 | 73 | $212 | $267 | $210 | $159 | $1.33 | $2.90 |

| Wapello County Average Farmland Rents | 56.6 | 81 | $241 | $300 | $235 | $188 | $1.42 | $2.98 |

| Warren County Average Farmland Rents | 57.3 | 85 | $215 | $245 | $212 | $188 | $1.25 | $2.53 |

| Washington County Average Farmland Rents | 68 | 82 | $287 | $339 | $283 | $239 | $1.44 | $3.50 |

| Wayne County Average Farmland Rents | 50.7 | 70 | $184 | $218 | $176 | $158 | $1.12 | $2.63 |

| Webster County Average Farmland Rents | 75.1 | 78 | $273 | $298 | $278 | $244 | $1.39 | $3.50 |

| Winnebago County Average Farmland Rents | 72.9 | 74 | $255 | $231 | $251 | $225 | $1.28 | $3.45 |

| Winneshiek County Average Farmland Rents | 59.2 | 77 | $272 | $320 | $264 | $233 | $1.39 | $3.53 |

| Woodbury County Average Farmland Rents | 61.4 | 73 | $300 | $348 | $295 | $257 | $1.45 | $4.11 |

| Worth County Average Farmland Rents | 73.8 | 77 | $245 | $268 | $247 | $218 | $1.24 | $3.18 |

| Wright County Average Farmland Rents | 78.6 | 79 | $270 | $310 | $266 | $235 | $1.40 | $3.42 |

Frequently Asked Questions from Land and Farm Sellers

It is never up to the auction company to charge a buyers premium, that is the sellers decision. Would we take an auction if the seller chose to use buyers premium to pay commission? Yes we do and have. We always thoroughly explain to the seller the use of a buyers premium and sellers commissions. Some sellers charge a buyers premium because they believe the auction process serves both the buyer and the seller, after all, they could have just sold the farm privately and not given buyers a chance to buy it. Other sellers believe buyers would not bid because of a buyers premium and choose to use only an undisclosed sellers commission. Either way, the buyers premium just becomes a part of the price of the real estate purchased and is added to the price. We believe bidders are accused to factoring in incidental costs and bidding accordingly and we believe sellers have the right to offer their farm in any format or term they desire. We of course insist on complete honesty and ensure any buyers fee is prominently advertised and known by bidders.

It is never up to the auction company to charge a buyers premium, that is the sellers decision. Would we take an auction if the seller chose to use buyers premium to pay commission? Yes we do and have. We always thoroughly explain to the seller the use of a buyers premium and sellers commissions. Some sellers charge a buyers premium because they believe the auction process serves both the buyer and the seller, after all, they could have just sold the farm privately and not given buyers a chance to buy it. Other sellers believe buyers would not bid because of a buyers premium and choose to use only an undisclosed sellers commission. Either way, the buyers premium just becomes a part of the price of the real estate purchased and is added to the price. We believe bidders are accused to factoring in incidental costs and bidding accordingly and we believe sellers have the right to offer their farm in any format or term they desire. We of course insist on complete honesty and ensure any buyers fee is prominently advertised and known by bidders.

Links of Interest to Farmland Owners

Iowa Farmland Real Estate and Auction Company

I’m always happy to help farmland sellers understand their assets. Our goal with DreamDirt was to provide a safe place for sellers to seek accurate information and learn about the process of selling farmland. We have helped thousands of clients sell assets and overwhelmingly our clients love our process. DreamDirt is different. We take our clients’ interests very seriously and we aren’t shy to admit when it comes to maximizing the value of their property, we will do absolutely everything we can. If you are selling farmland, we offer a myriad of services and options to help you deal with your own situation in the way that best fits you. From our live in-person, auctions, private listings, online auctions, or consultations our team is sharp. They always strive to achieve the best possible outcome 100% of the time. We’d love to hear from you and have an opportunity to earn your business.

Insights from the REALTORS® Land Institute: Understanding Iowa’s Farmland Market Trends

Iowa Land Price Trends At DreamDirt Auctions, we're committed to keeping our audience of landowners informed about the latest developments in the agricultural real estate market. Today, we're excited to share insights from the REALTORS® Land Institute - Iowa Chapter's...

Unlocking the Value of Nebraska Farmland: A Comprehensive Guide to Current Land Prices and Expert Insights – February 2024 Report

Welcome to Our Monthly Nebraska Farmland Value Report In this monthly report, Jason Smith, Nebraska Land Broker and Auctioneer dives into Nebraska farmland values, helping you understand the factors that determine what your farm is potentially worth. Our goal as...

Unlocking the Value of Minnesota Farmland: A Comprehensive Guide to Current Land Prices and Expert Insights – February 2024 Report

Welcome to Our Monthly Minnesota Farmland Value Report In this monthly report, Jason Smith, Land Broker and Auctioneer dives into Minnesota farmland values, helping you understand the factors that determine what your farm is potentially worth. Our goal as auctioneers...