Unlocking the Value of Illinois Farmland: A Comprehensive Guide to Current Land Prices and Expert Insights - February 2024 Report

Welcome to Our Monthly Illinois Farmland Value Report

In this monthly report, Rachel Tiffany, Land Broker and Auctioneer dives into Illinois farmland values, helping you understand the factors that determine what your farm is potentially worth. Our goal as auctioneers and farmland real estate agents is to provide you with up-to-date information, recent sales data, expert insights, and tips for maximizing the potential value of your farmland sale. Let us answer the questions you have about selling farmland in Illinois. Contact us today for a free consultation.

Understanding Illinois Farmland Values:

Factors Influencing Farmland Values in Illinois

Illinois’s agricultural landscape is influenced by a multitude of factors. In this blog, we will explore how commodity prices, interest rates, government policies, and regional conditions impact the current market values.

For farmers, one of the most pressing challenges in the previous year was the escalating costs of inputs such as fertilizers and pesticides. The conflict between Russia and Ukraine worsened this situation, driving up fertilizer prices due to disruptions in production and increased demand from other nations striving to mitigate the shortfall.

Although costs remain high in 2024, there are some signs of relief in U.S. markets. Fertilizer prices, particularly for nitrogen-based products, have seen notable decreases. For example, anhydrous ammonia, which was priced above $1,200 per ton early last year, has now fallen to the range of $700 to $800 per ton—a significant decline.

While there has been some easing in crop input costs, pesticide prices have decreased slightly but not to the same extent as fertilizers, while seed prices have remained relatively stable or even increased slightly. Despite these improvements, overall costs remain elevated.

Many have drawn parallels between the current economic situation and the farm crisis of the 1980s, given the high inflation witnessed across the United States in recent years and the government’s actions to raise interest rates in 2023 to combat inflation. However, it’s important to note that while there are similarities in terms of inflation and interest rates, the current land market is better positioned to withstand these pressures, with the scarcity of available labor being a more significant outcome of present inflationary forces.

Recent Farmland Sales Data

Let’s dive into the latest sales data, including county location, land size by acre amount, soil productivity ratings, and sale prices per acre and total price in the table below. By analyzing this data, you can get a clearer picture of how your property may be valued in the current market.

Average Price of Farmland in Illinois

• In the month of February, a total of 3967.39 acres were sold in Illinois by the auction sales method.

• The current average per acre price for land in Illinois according to these February sales is $10,576 /acre.

• The highest selling farm in Illinois in the month of February 2024 sold on February 8th in Lee County for $2,575,450 or $9,500 per acre for 271.1 acres, with a PI of 113.3.

• The farm with the highest selling per acre price also sold on February 1st in Christian County for $20,100 per acre for 103.87 acres, with a PI of 134.6.

• See full results from all farmland sold this month at the end of the page.

Despite the notable surge in land values observed a year ago, which was driven by strong commodity markets, the momentum has since tapered off. However, the present trend suggests that these values are holding steady. Notably, in the face of high interest rates, there has been an increase in lending, as reported by the Federal Reserve Bank of Kansas City.

Market Trends and Future Projections:

Illinois Land Market Trends

Each month we like discuss current trends in Illinois farmland sales, highlighting patterns, emerging opportunities, and potential challenges.

Our data proves the trend that sales are slowing as we continue into 2024. Overall, the market has experienced about a 35% decrease in volume of sales. Additionally, lower commodity prices may tighten profit margins in the next growing season, influencing investor behavior. However, with low supply, demand for premium farms remains consistent across the corn belt.

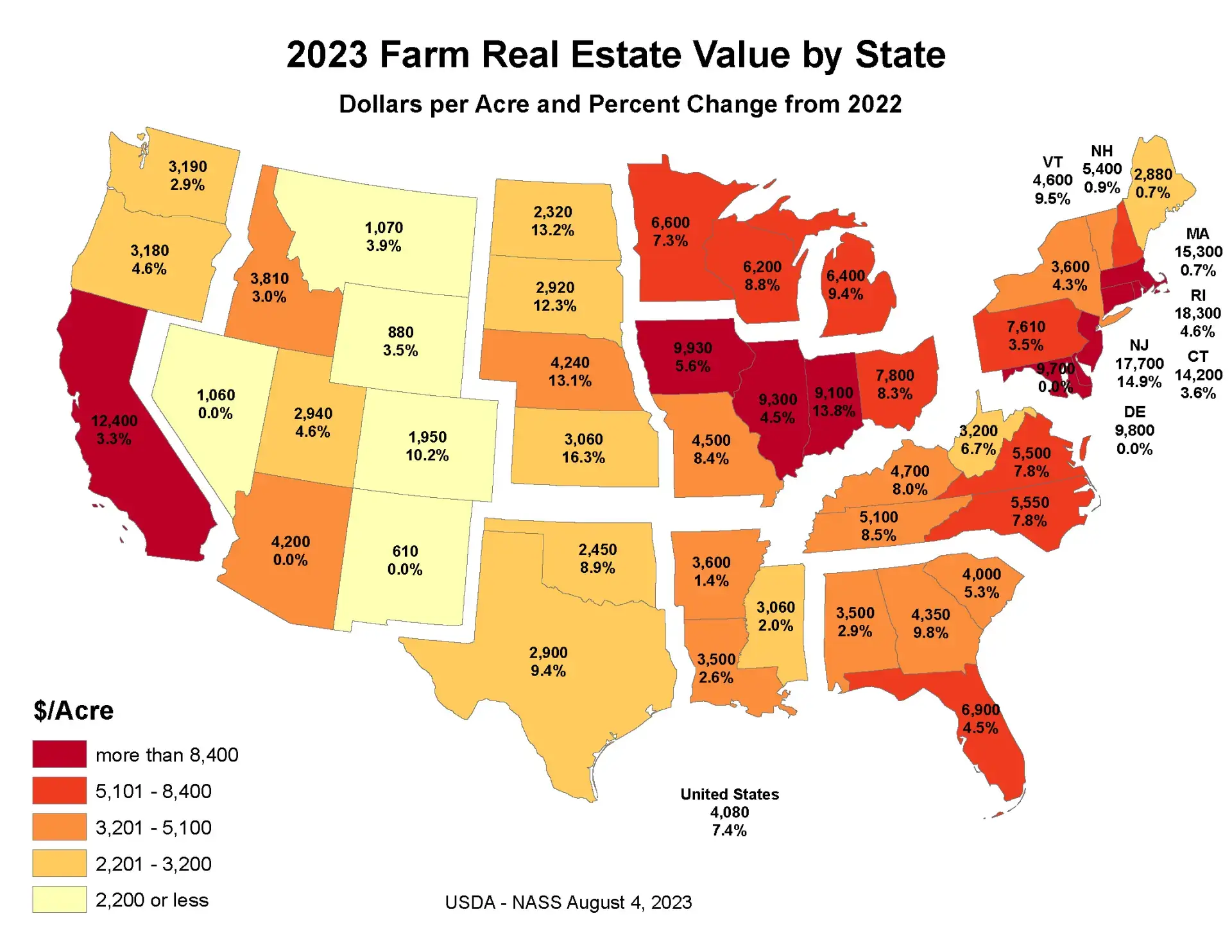

According to the USDA-National Agricultural Statistics Services (USDA-NASS) survey released in February 2023, Illinois’s farm real estate value experienced a 4.5% increase, averaging $9,300 per acre—an annual growth of $400.50/acre. These statistics highlight the steady growth and market dynamics within Illinois’s agricultural real estate landscape in 2023.

Future Predictions for Farmland Values

Here you will gain insights into the future of Illinois’s farmland market with our expert forecasts. Understand what to expect in the coming months and years. Here’s what we are predicting:

In general, for farmers and landowners alike, 2024 seems poised to resemble 2023, with U.S. land values expected to remain relatively stable throughout the year, barring any significant economic upheavals akin to the COVID-19 pandemic. The market outlook suggests a sense of consistency, with land values largely maintaining their current levels. Despite the persistent high costs of production inputs and subdued commodity prices, farm incomes may experience a slight downturn, although overall profit margins are anticipated to remain comparable to those observed in 2023.

As we navigate through 2024, despite facing higher costs and lower commodity prices, our incomes are generally positive, which typically results in the stabilization of farmland prices. Significant shifts in farmland prices are unlikely without substantial catalysts—either positive or negative—occurring during the year. Thus, we anticipate a period of plateauing until such events transpire, with minimal adjustments expected in farm incomes by the year’s end.

Consequently, we envisage cash rent levels to remain relatively unchanged, possibly with a slight downward pressure on the upper end. Interest rates are stabilizing, contributing to overall market stability. As interest rates show no signs of increase, and rental rates for Midwest farmland remain steady, significant fluctuations are unlikely until external factors come into play.

Landowners considering selling their land in 2024 will find themselves in a favorable situation, with stable land values and a consistent stream of interested buyers. With real estate inventory remaining scarce in numerous areas, those looking to sell this year may fetch higher prices than in previous years.

Navigating the Selling Process:

Tips for Selling Your Farm in Illinois

Explore a set of practical tips for successfully selling your farmland by downloading our free eBooks here. Schedule a non obligatory consultation with us today and we will cover everything from when is the best time to sell, a customized marketing plan, sales methods, how we can help you find the right buyer, and answer your questions.

Farm Real Estate Experts in Illinois

Meet our team of Illinois farm real estate and auction experts who can provide you with valuable guidance and personalized assistance throughout the selling process. If you’re looking to uncover the true value of your Illinois farm or are considering selling, don’t hesitate to reach out to our experienced team. We’re here to provide you with a customized plan to meet your goals. Contact us today to get started.

Rachel Tiffany

Auctioneer & Land Broker

Rachel is a licensed real estate broker assistant, auctioneer, and farmland agent in Iowa and managing broker and auctioneer in Illinois specializing in the sale of farm, land, and rural residential real estate. She is a graduate of Iowa State University, where she received a Bachelor’s in Animal Science with a minor in Agricultural Business. She is also a graduate of the National Auctioneers Association Certified Auctioneer Institute (CAI) school in March 2023. Rachel is eager to answer your questions, talk with you about your farm, and help you gain a deep understanding of your options as a seller. If you’re considering selling land, or even just curious about your options for the future, please don’t hesitate to reach out to her.

Email: [email protected] | Phone: 515-954-8063

Assessing Your Farm’s Worth:

Illinois Land Market Analysis Appraisal Technique

Curious what your farm could sell for? We prepare market analysis for each of our farmland sellers to help you discover and learn what your farm is worth from our market based research and expertise. Fill out our form here to request a market analysis of your Illinois farmland or call us at 402-739-8696

| County | Total Acres | $/Acre | Tillable Acres | $/Tillable Acre | PI Soil Score | Total Price | Date Sold |

|---|---|---|---|---|---|---|---|

| Saline | 80 | $7,050 | 69.26 | $8,143 | 100.9 | $564,000 | 2/29/24 |

| LaSalle | 255.4 | $10,000 | 156.01 | $16,371 | 111.6 | $2,554,000 | 2/29/24 |

| McLean | 81.29 | $15,450 | 79.9 | $15,719 | 137.8 | $1,255,930 | 2/29/24 |

| McLean | 139.53 | $15,700 | 131 | $16,722 | 128.2 | $2,190,621 | 2/28/24 |

| McLean | 139.53 | $15,700 | 138 | $15,874 | 130.2 | $2,190,621 | 2/28/24 |

| McLean | 41.65 | $17,200 | 41.43 | $17,291 | 132 | $716,380 | 2/27/24 |

| Christian | 97.45 | $5,700 | 8.5 | $65,349 | 91.3 | $555,465 | 2/22/24 |

| Fayette | 45.5 | $6,050 | 25.21 | $10,919 | 100 | $275,275 | 2/22/24 |

| Macoupin | 75.17 | $9,300 | 57.13 | $12,237 | 117.6 | $699,081 | 2/16/24 |

| Wabash | 42.35 | $5,200 | 36.87 | $5,973 | 99.1 | $220,220 | 2/16/24 |

| Wabash | 6.23 | $13,000 | 5.04 | $16,069 | 111.2 | $80,990 | 2/16/24 |

| Wabash | 17.41 | $10,100 | 16.41 | $10,715 | 103.5 | $175,841 | 2/16/24 |

| Wabash | 13.94 | $10,350 | 6.55 | $22,027 | 112.7 | $144,279 | 2/16/24 |

| Stark | 114.87 | $16,800 | 114.87 | $16,800 | 137.2 | $1,929,816 | 2/15/24 |

| Stark | 77.37 | $11,000 | 75.98 | $11,201 | 121.6 | $851,070 | 2/15/24 |

| Stark | 37.2 | $9,150 | 25.73 | $13,229 | 120.9 | $340,380 | 2/15/24 |

| Stark | 33.63 | $7,200 | - | - | 92 | $242,136 | 2/15/24 |

| Stark | 74.66 | $9,000 | 70.32 | $9,555 | 138.2 | $671,940 | 2/15/24 |

| Stark | 45 | $8,400 | 39.91 | $9,471 | 140.9 | $378,000 | 2/15/24 |

| Stark | 90.61 | $5,750 | 23.94 | $21,763 | 87.7 | $521,008 | 2/15/24 |

| Stark | 84.79 | $7,200 | 36.53 | $16,712 | 82.6 | $610,488 | 2/15/24 |

| Stark | 107.76 | $8,600 | 82.58 | $11,222 | 123 | $926,736 | 2/15/24 |

| Macoupin | 81.1 | $14,500 | 81.1 | $14,500 | 133 | $1,175,950 | 2/15/24 |

| Macoupin | 81.17 | $18,450 | 81.17 | $18,450 | 133.5 | $1,497,586 | 2/15/24 |

| Macoupin | 161.78 | $14,050 | 143.68 | $15,820 | 127.9 | $2,273,009 | 2/15/24 |

| Knox | 81.54 | $8,750 | 56.22 | $12,691 | 121.4 | $713,475 | 2/13/24 |

| Douglas | 106.2 | $17,600 | 105.9 | $17,650 | 128.5 | $1,869,120 | 2/13/24 |

| Marion | 40 | $13,362 | 40 | $13,362 | 102.1 | $534,500 | 2/8/24 |

| Marion | 80 | $13,306 | 80 | $13,306 | 101.7 | $1,064,500 | 2/8/24 |

| Marion | 33.4 | $3,159 | 7.5 | $14,067 | 102.3 | $105,500 | 2/8/24 |

| Lee | 271.1 | $9,500 | 239.88 | $10,736 | 113.3 | $2,575,450 | 2/8/24 |

| Edwards | 76.5 | $1,544 | - | - | 114.6 | $118,100 | 2/8/24 |

| Vermilion | 12.55 | $7,000 | 4.71 | $18,652 | 109.2 | $87,850 | 2/8/24 |

| Vermilion | 10.83 | $19,004 | 10 | $20,581 | 141 | $205,813 | 2/8/24 |

| Henry | 40 | $16,500 | 38.68 | $17,063 | 144.6 | $660,000 | 2/6/24 |

| Bureau | 80 | $13,750 | 75.77 | $14,518 | 136.1 | $1,100,000 | 2/6/24 |

| Henry | 40.95 | $11,900 | 40.17 | $12,131 | 136.5 | $487,305 | 2/6/24 |

| Jackson | 14.9 | $3,758 | 7.68 | $7,292 | 101.9 | $56,000 | 2/6/24 |

| Will | 187.75 | $7,500 | 171.78 | $8,165 | 118.3 | $1,402,500 | 2/6/24 |

| Bureau | 75.57 | $13,894 | 71.91 | $14,602 | 138.8 | $1,050,000 | 2/4/24 |

| Christian | 103.87 | $20,100 | 102.74 | $19,564 | 134.6 | $2,010,000 | 2/1/24 |

| Schuyler | 120.75 | $10,000 | 102.92 | $11,732 | 127.7 | $1,207,500 | 2/1/24 |

| Schuyler | 206.63 | $11,250 | 183.32 | $12,680 | 132.7 | $2,324,588 | 2/1/24 |

| Schuyler | 40.16 | $8,500 | 39.38 | $8,668 | 118 | $341,360 | 2/1/24 |

| Schuyler | 85.63 | $10,300 | 79.18 | $11,139 | 123 | $881,989 | 2/1/24 |

| Schuyler | 70.32 | $7,700 | 63.95 | $8,467 | 108.2 | $541,464 | 2/1/24 |

| Schuyler | 14.54 | $4,600 | 12.3 | $5,438 | 102.6 | $66,884 | 2/1/24 |

| Schuyler | 148.81 | $3,750 | - | - | 128.1 | $558,038 | 2/1/24 |

| STATEWIDE AVERAGES | 82.65 | $10,576 | 68.47 | $14,770 | 118.75 | $895,891 | |

| STATEWIDE TOTALS | 3967.39 | 3081.11 | $664,636 | $43,002,758 |