Unlocking the Value of Iowa Farmland: A Comprehensive Guide to Current Land Prices and Expert Insights - March 2024 Report

Welcome to Our Monthly Iowa Farmland Value Report

In this monthly report, we dive into Iowa farmland values, helping you understand the factors that determine what your farm is potentially worth. Our goal as auctioneers and farmland real estate agents is to provide you with up-to-date information, recent sales data, expert insights, and tips for maximizing the potential value of your farmland sale. Let us answer the questions you have about selling farmland in Iowa. Contact us today for a free consultation.

Understanding Iowa Farmland Values:

Factors Influencing Farmland Values in Iowa

Iowa’s agricultural landscape is influenced by a multitude of factors. In this blog, we will explore how commodity prices, interest rates, government policies, and regional conditions impact the current market values.

Farmland values in the upper Midwest surged in 2023, reaching unprecedented highs across many regions. The robust farm income of the preceding years empowered operators with surplus funds, fueling investments in farmland. This, coupled with limited land availability, sustained elevated land values in Iowa and the Midwest. Despite varied crop yields due to weather fluctuations, the market remained resilient, buoyed by strong early crop prices. Remarkably, even with soaring real estate interest rates, land values remained largely unaffected.

The renowned Iowa State Land Value Survey, conducted annually, offers invaluable insights into Midwest farmland trends, drawing on actual sales data and expert opinions. In 2023, Iowa farmland averaged $11,835 per acre, surpassing the previous record set in 2022. Over the past seven years, values soared by 65%, reflecting a robust market. The USDA reported significant land value hikes across the upper Midwest, notably in Iowa, despite periodic droughts.

In 2023, land values surged across Iowa’s reporting districts, except for a slight dip in the northwest. Notably, the southeast district saw the highest increase at 12.8%, driven by strong local demand. Active farmers dominated purchases, expanding their operations and accounting for approximately 70% of farmland purchases in Iowa in 2023. Real estate investors also played a substantial role at 24%, with half of them reported to be retired farmers. The primary drivers of this bullish market were robust farm incomes, limited land supply, and vigorous local demand.

Over 18 months, the U.S. Federal Reserve raised the prime interest rate by 5.25%, elevating it from 3.25% in early 2022 to 8.50% by mid-summer 2023, where it currently stands. Discussions within the Federal Reserve suggest potential modest decreases in the prime interest rate throughout 2024, though certainty remains elusive. Prior to 2022, the prime rate had remained unchanged for almost three years, fostering a stable financing landscape for farmland.

Recent Farmland Sales Data

Let’s dive into the latest sales data, including county location, land size by acre amount, soil productivity ratings, and sale prices per acre and total price in the table below. By analyzing this data, you can get a clearer picture of how your property may be valued in the current market.

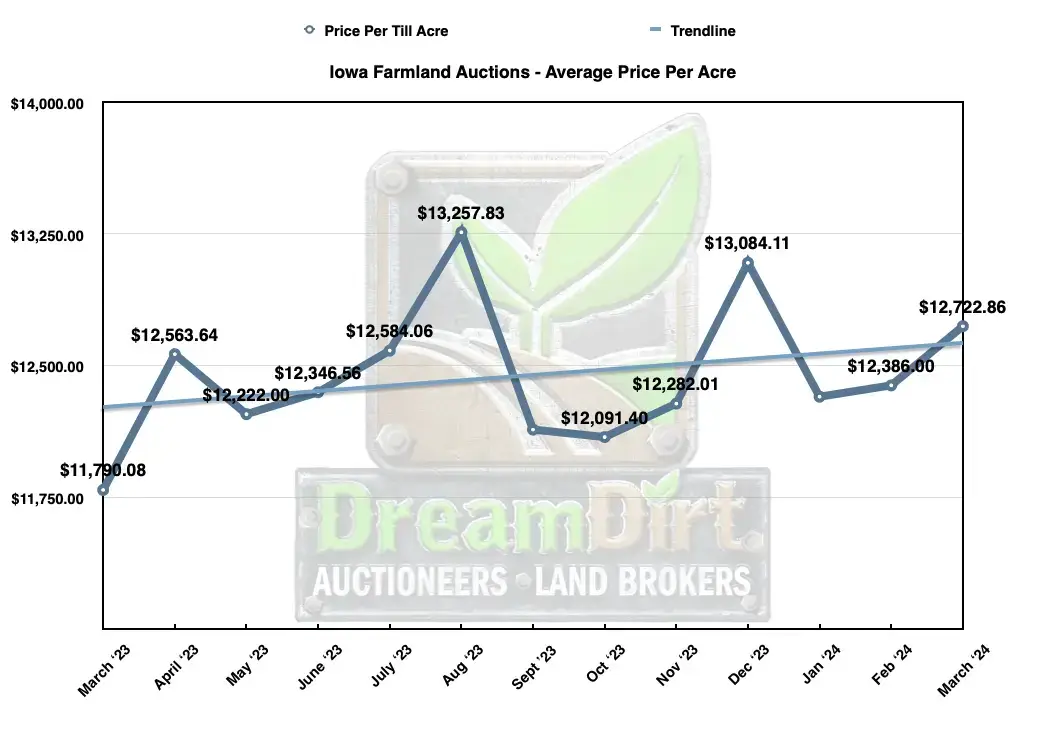

Current Average Price Per Acre of Farmland in Iowa

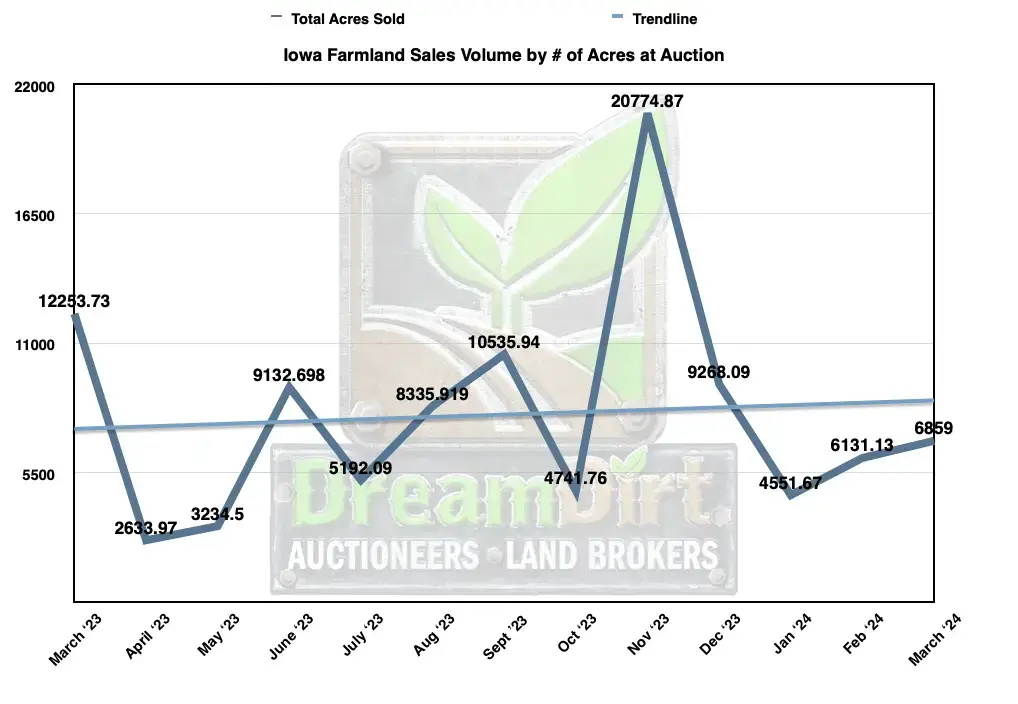

- In the month of March, a total of 6,859 acres of land was sold in Iowa by auction

- The current average per acre price for land in Iowa according to March Auction sales is $10,802 per acre

- The highest selling farm in Iowa in the month of March sold on the 6th in Audubon County for $15,800 per acre.

- This farm was sold by the auction method for a total of $3,688,352 and was 233.44 acres of farmland which has a soil score rating of 78.6 CSR2 calculating to be $211/CSR point on a 95.4% tillable farm in Northwest Iowa.

- The highest dollars per acre farm in Iowa that sold in the month of March went to a 74.41 acre farm in Sioux County, IA which sold for $27,750 per acre on March 7th, 2024 by auction. This farm has a 94.5 CSR2 rating which calculates to be $306 per CSR2 point. Incredible farmland sold result in Northwest Iowa.

- See full results from all 79 tracts of farmland that sold in table at end of the page.

- See how these averages compared to February and a year ago below in next section below to see trend line history.

Jason J Smith

Auctioneer & Land Broker

Jason is an experienced farmland broker and auctioneer with extensive experience in farmland sales across this Midwest. Jason has worked with hundreds of clients to create advantageous outcomes. If you are selling land schedule a consultation with Jason by calling or using the calendar.

Phone: 515-537-6633

Market Trends and Future Projections:

Each month we like discuss current trends in Iowa farmland sales, highlighting patterns, emerging opportunities, and potential challenges.

Current Farmland Prices in Iowa: A 12-Month Overview

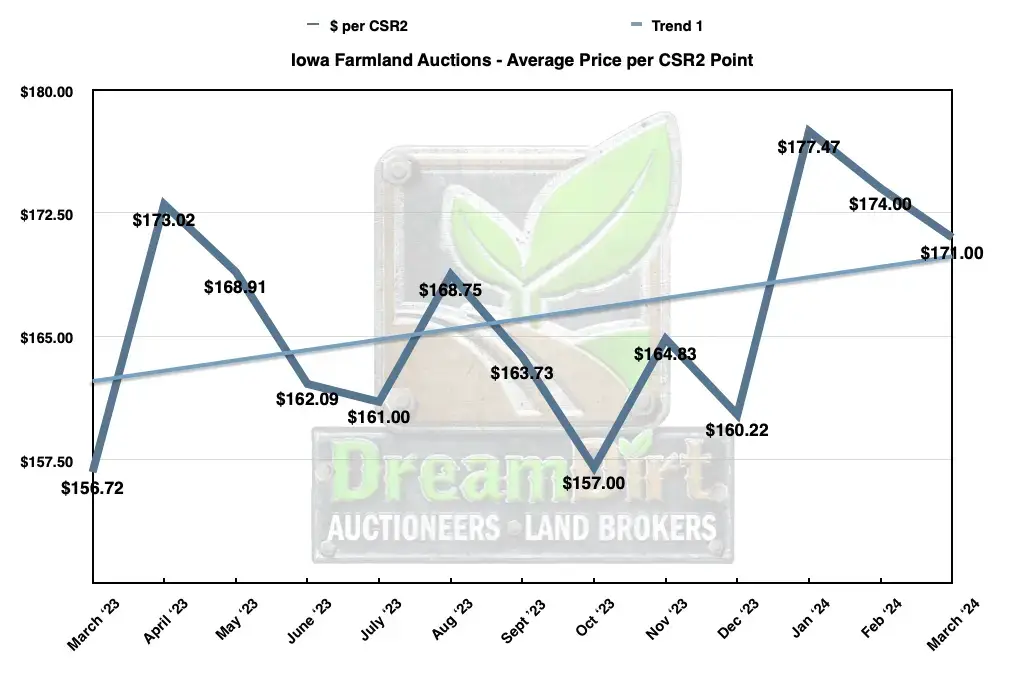

March Iowa Auction Results: Average Price Per CSR2 Point

March Iowa Auction Results: Increase in Acres Sold

Future Predictions for Farmland Values

Here you will gain insights into the future of Iowa’s farmland market with our expert forecasts. Understand what to expect in the coming months and years.

In the 2023 Iowa State Land Value Survey, participants shared their outlook on future farmland values over the next five years. Forty-eight percent anticipate a decrease in Iowa farmland values by the end of 2024, with most predicting a decline of 5% or less. Twenty-two percent foresee stability in farmland values over the next year, while 30% predict an increase by the end of 2024. Looking ahead, 70% of respondents anticipate land values to rise over the next five years, with many expecting an increase of 10-20%, while 30% believe values may either remain steady or decline in the coming years.

According to the Ag Economists’ Monthly Monitor, a survey of 70 ag economists from across the country, there is a projected major drop in net farm income this year for farmers. The economists surveyed forcasted net farm income to decrease to $117 billion in 2024, a figure notably lower than the USDA’s projection of $121.7 billion for the same period. However, given that this is an election year, certain economists speculate that a decline in net farm income might be alleviated by Congressional intervention. Additionally, some economists believe that the resilience of the U.S. balance sheet will also provide a buffer against the anticipated downturn.

Given the anticipated decline in net farm income this year, the latest Ag Economists’ Monthly Monitor sought insights from economists regarding the potential repercussions for the agricultural economy in the coming years. According to one economist, while immediate consequences are expected to be relatively minimal, ongoing decreases in farm income beyond 2025 could exacerbate the situation. Potential impacts mentioned by economists include a slowdown in equipment sales, moderation of land values and rental rates, increased consolidation among farm service businesses, and adverse effects on financial ratios.

The anonymous survey revealed potential outcomes from a sharp drop in net farm income. One economist warned that those who considered 2021-2022 as a new norm for stable commodity prices might face overextension in the current downturn. Another highlighted potential significant losses for corn farmers this year. They noted that corn prices could dip below production costs for many, a situation not seen since the ethanol boom nearly two decades ago. Others expressed concerns about a slowdown in new equipment sales, a leveling off of land value growth, and deteriorating financial conditions for U.S. wheat producers. They also noted that farmers without significant cash reserves might face financial pressure, potentially leading to declining rental rates. Despite these challenges, economists anticipate strong farm balance sheets, continued demand for biofuels and new markets, decreasing input costs, and robust consumer demand, particularly for beef, with overall strength in other commodities.

Navigating the Selling Process:

Tips for Selling Your Farm in Iowa

Explore a set of practical tips for successfully selling your farmland by downloading our free eBooks here. Schedule a non obligatory consultation with us today and we will cover everything from when is the best time to sell, a customized marketing plan, sales methods, how we can help you find the right buyer, and answer your questions.

Farm Real Estate Experts in Iowa

Meet our team of Iowa farm real estate and auction experts who can provide you with valuable guidance and personalized assistance throughout the selling process. If you’re looking to uncover the true value of your Iowa farm or are considering selling, don’t hesitate to reach out to our experienced team. We’re here to provide you with a customized plan to meet your goals. Contact us today to get started.

Assessing Your Farm’s Worth:

Iowa Land Market Analysis Appraisal Technique

Curious what your farm could sell for? We prepare market analysis for each of our farmland sellers to help you discover and learn what your farm is worth from our market based research and expertise. Fill out our form here to request a market analysis of your Iowa farmland.

Recently Sold Land in Iowa Price Results

| COUNTY | TOTAL ACRES | $ / ACRE | TILLABLE ACRES | TILLABLE CSR2 | $/TILLABLE CSR2 | LAND TYPE | SOLD DATE |

|---|---|---|---|---|---|---|---|

| Black Hawk | 156.00 | $10,100 | 143.75 | 80.2 | $137 | Tillable | 03/01/24 |

| Carroll | 148.98 | $11,625 | 148.35 | 63.4 | $184 | Tillable | 03/04/24 |

| Crawford | 80.00 | $12,900 | 73.84 | 77.6 | $180 | Tillable | 03/05/24 |

| Butler | 145.18 | $6,000 | 132.8 | 57.9 | $113 | Tillable | 03/05/24 |

| Butler | 15.5 | $5,350 | - | - | - | Woods | 03/05/24 |

| Franklin | 37.93 | $5,500 | 37.23 | 40.5 | $138 | Tillable | 03/05/24 |

| Hardin | 76 | $7,300 | 69.03 | 86.2 | $93 | Tillable | 03/06/24 |

| Audubon | 233.44 | $15,800 | 222.59 | 78.6 | $211 | Tillable | 03/06/24 |

| Marshall | 18.38 | $3,150 | 0 | - | - | Woods | 03/06/24 |

| Lee | 38.95 | $10,800 | 37 | 80.8 | $141 | Tillable | 03/07/24 |

| Lee | 69.94 | $11,800 | 63.02 | 89.6 | $146 | Tillable | 03/07/24 |

| Lee | 222.48 | $10,400 | 215.71 | 75.9 | $141 | Tillable-CRP | 03/07/24 |

| Lee | 102 | $6,000 | 95.33 | 45.4 | $141 | Tillable | 03/07/24 |

| Sioux | 74.41 | $27,750 | 71.3 | 94.5 | $306 | Tillable | 03/07/24 |

| Sioux | 194.29 | $18,700 | 191.46 | 91.3 | $208 | Tillable | 03/07/24 |

| Sioux | 79.86 | $15,200 | 76.32 | 86.2 | $185 | Tillable | 03/07/24 |

| Sioux | 80.74 | $17,400 | 78.21 | 78.21 | $230 | Tillable-CRP | 03/08/24 |

| Plymouth | 40 | $18,000 | 37.88 | 84 | $226 | Tillable | 03/08/24 |

| Plymouth | 31.78 | $16,100 | 31.78 | 89.6 | $180 | Tillable | 03/08/24 |

| Plymouth | 35.76 | $11,600 | 16.56 | 72 | $348 | Pasture-Tillable | 03/08/24 |

| Wapello | 64 | $4,500 | - | - | - | Recreation | 03/09/24 |

| Woodbury | 113.68 | $7,550 | 105 | 44.8 | $182 | Tillable | 03/11/24 |

| Boone | 31.42 | $5,800 | - | - | - | Woods | 03/12/24 |

| Webster | 47 | $14,400 | 46.83 | 87.7 | $165 | Tillable | 03/12/24 |

| Worth | 73.8 | $14,100 | 64.47 | 86.3 | $187 | Tillable | 03/13/24 |

| Worth | 69.99 | $10,000 | 66.75 | 79.3 | $132 | Tillable- Wind Turbine | 03/13/24 |

| Worth | 112.29 | $12,200 | 104.86 | 83.6 | $156 | Tillable- 2 Wind Turbines | 03/13/24 |

| Iowa | 95 | $9,000 | 75.86 | 54.7 | $206 | CRP | 03/13/24 |

| Webster | 115.95 | $14,300 | 110.1 | 86.3 | $175 | Tillable | 03/14/24 |

| Palo Alto | 149 | $11,200 | 147 | 77 | $147 | Tillable | 03/14/24 |

| Webster | 80 | $12,100 | 74.88 | 71.2 | $182 | Tillable | 03/14/24 |

| Van Buren | 80 | $6,600 | 50.25 | 41.1 | - | Tillable-Recreation | 03/15/24 |

| Van Buren | 80 | $5,900 | 24.64 | 34.5 | - | Recreation-Tillable | 03/15/24 |

| Monona | 138.6 | $7,900 | 137.38 | 70.5 | $113 | Tillable | 03/15/24 |

| Monona | 235.5 | $8,000 | 196.72 | 58.9 | $163 | Tillable | 03/15/24 |

| Taylor | 72 | $7,300 | 59.29 | 67.5 | $131 | CRP | 03/15/24 |

| Lyon | 77.14 | $14,750 | 72.59 | 64.2 | $244 | Tillable | 03/18/24 |

| Fayette | 75 | $10,000 | 73.63 | 74.3 | $137 | Tillable | 03/19/24 |

| Fayette | 80 | $11,200 | 78.19 | 86.5 | $132 | Tillable | 03/19/24 |

| Winnebago | 60 | $5,750 | 54.84 | 52 | $121 | CRP-Tillable | 03/19/24 |

| Poweshiek | 154.5 | $19,500 | 150.47 | 93.1 | $215 | Tillable | 03/19/24 |

| Fremont | 131.83 | $8,700 | 130.82 | 70.9 | $124 | Tillable-Irrigation | 03/19/24 |

| Fremont | 154.83 | $6,500 | 149.29 | 60.9 | $111 | Tillable-CRP | 03/19/24 |

| Fremont | 36.07 | $8,800 | 36.62 | 67.9 | $128 | Tillable | 03/19/24 |

| Appanoose | 15 | $7,900 | - | - | - | Woods | 03/19/24 |

| Appanoose | 59.00 | $7,500 | 58.34 | 51 | $149 | Tillable | 03/19/24 |

| Appanoose | 76.00 | $8,000 | 69.86 | 54.7 | $159 | Tillable | 03/19/24 |

| Grundy | 77.48 | $18,583 | 77.48 | 96.1 | $193 | Tillable | 03/20/24 |

| Grundy | 74.66 | $17,533 | 74.66 | 96.7 | $181 | Tillable | 03/20/24 |

| Grundy | 77.81 | $15,033 | 77.8 | 92.7 | $162 | Tillable | 03/20/24 |

| Van Buren | 62.8 | $6,600 | 47.27 | 49.6 | - | Tillable-Recreation | 03/20/24 |

| Van Buren | 33.79 | $7,300 | 24.11 | 45.6 | - | Tillable-Recreation | 03/20/24 |

| Floyd | 49.81 | $6,510 | 20.30 | 62.7 | - | CRP | 03/21/24 |

| Floyd | 39.64 | $6,431 | 38.14 | 48.5 | $138 | Tillable | 03/21/24 |

| Black Hawk | 98.29 | $13,300 | 92.09 | 88.1 | $161 | Tillable | 03/21/24 |

| Grundy | 92.03 | $13,300 | 88.25 | 81.9 | $169 | Tillable | 03/21/24 |

| Washington | 80 | $20,750 | 76 | 86 | $254 | Tillable | 03/22/24 |

| Washington | 62 | $8,600 | 53.5 | 60 | $166 | CRP | 03/22/24 |

| Woodbury | 117 | $10,200 | 110.3 | 56.9 | $190 | Tillable | 03/22/24 |

| Woodbury | 80 | $9,500 | 70.18 | 48.1 | $225 | Tillable | 03/22/24 |

| Sioux | 76.83 | $26,500 | 73.07 | 99 | $281 | Tillable | 03/25/24 |

| O'Brien | 140 | $18,100 | 135.85 | 95.9 | $195 | Tillable | 03/26/24 |

| Page | 158.5 | $6,200 | 134.5 | 67.4 | $108 | Tillable | 03/26/24 |

| Washington | 73.05 | $5,675 | 49.12 | 41.2 | - | CRP-Recreation | 03/27/24 |

| Osceola | 80.14 | $13,000 | 67.36 | 92.2 | $168 | Tillable | 03/27/24 |

| Boone | 78 | $11,100 | 70.5 | 83.9 | $146 | Tillable | 03/27/24 |

| Harrison | 80 | $11,500 | 78.34 | 78.5 | $150 | Tillable-CRP | 03/28/24 |

| Union | 53.86 | $5,800 | 50 | 51.4 | $122 | Tillable-CRP | 03/28/24 |

| Union | 149.31 | $6,950 | 133.43 | 68.4 | $114 | Tillable-CRP | 03/28/24 |

| Van Buren | 50.96 | $9,371 | 36.87 | 57.3 | $226 | CRP | 03/28/24 |

| Dallas | 80 | $14,100 | 75.14 | 84.8 | $177 | Tillable | 03/28/24 |

| Dallas | 88.75 | $9,500 | 41.2 | 85.2 | - | Tillable-Recreation | 03/28/24 |

| Wayne | 61.3 | $8,000 | 60.11 | 46 | $177 | Tillable | 03/28/24 |

| Wayne | 80.33 | $6,300 | 73.72 | 41.9 | $164 | Tillable | 03/28/24 |

| Wayne | 41.73 | $5,400 | 36.09 | 42 | $149 | Tillable | 03/28/24 |

| Floyd | 37.35 | $12,550 | 32.2 | 80.8 | $180 | CRP | 03/28/24 |

| Mahaska | 107 | $5,200 | 55.8 | 81.2 | $123 | Tillable | 03/28/24 |

| Emmet | 78.38 | $8,262 | 59 | 71.5 | $154 | Tillable-Pasture-Mining | 03/28/24 |

| Winneshiek | 38.48 | $15,300 | 36.5 | 82 | $197 | Tillable | 03/29/24 |

| STATEWIDE AVERAGES | 86.82 | $10,802 | 80.40 | 71.0 | $171 | ||

| STATEWIDE TOTALS | 6,859 | 6,030 |